missouri no tax due system

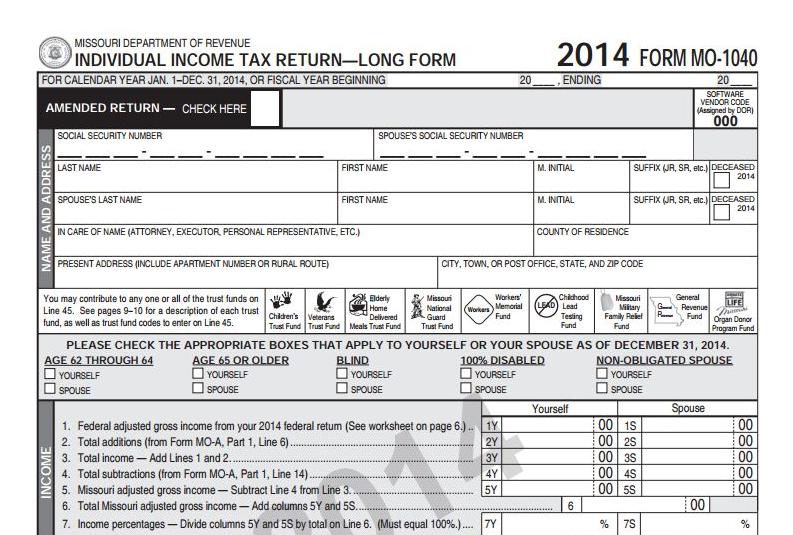

The due date for the 2022 Missouri Individual Income Tax Return is April 18 2023. The 4225 percent state sales and use tax is distributed into four funds to finance portions of state government General Revenue 30 percent Conservation 0125 percent Education 10.

How Missouri Helps Abortion Opponents Divert State Taxes To Crisis Pregnancy Centers Propublica

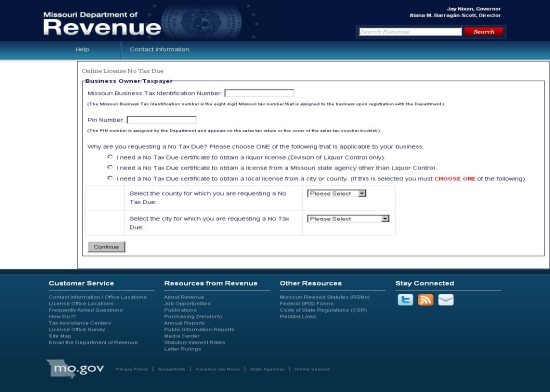

If there is an issue with the business account and a no tax due cannot be issued the system will present a message that the business must contact the Department of Revenue.

. State law section 144083 RSMo requires businesses to demonstrate they are compliant with state sales and withholding tax laws before they can receive or obtain certain. Office of the controller. Indicate the date to the template using the Date tool.

If you need. A business or organization that has received an exemption letter from the Department of Revenue should contact the SalesUse Refund and Exemption Section at 573-751-2836 or. Certificate of no tax due.

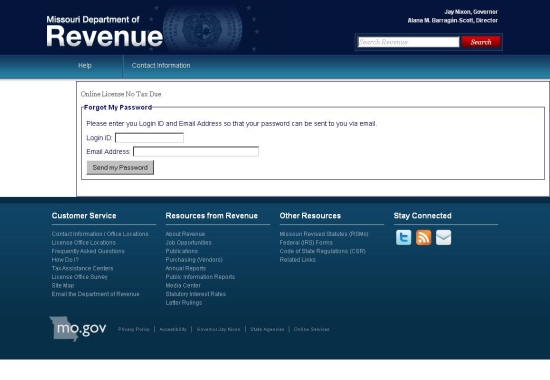

Request for Information of State Agency License No Tax. If you need a No Tax Due Certificate for any other reason you can contact the Tax Clearance Unit at 573 751-9268. Use tax is imposed on the storage use or.

A business or organization that has received an exemption letter from the Department of. Tax Clearance please fill out a Request for Tax. Missouri no tax due system Sunday February 27 2022 Edit.

The states sales tax is imposed on the purchase price of tangible personal property or taxable service sold at retail. No Franchise Tax Due Form MO-NFT - 2014 No Franchise Tax Due Reset Form Form MO-NFT Department Use. Please enter your MOID and PIN below in order to obtain a statement of No Tax Due.

Office of the controller. When purchasing goods and. A business or organization that has received an exemption letter from the Department of Revenue should contact the SalesUse Refund and Exemption Section at 573.

Click on the Sign tool and. Be sure the information you add to the No Tax Due Request - Missouri - Dor Mo is up-to-date and accurate. Online License No Tax Due System.

UM System Finance Policy 22212. By MOGov Staff Published April 19 2017 Full size is 133 160 pixels. The extension due date for the 2022 Missouri Individual Income Tax Return is October 16 2023.

Missouri Department of Revenue. Pay Business Taxes Online.

How Do State And Local Sales Taxes Work Tax Policy Center

Carthage Public Library Carthage Missouri

Explainer Tax Cut Trend Reaches Missouri Many Other States

States With The Highest Lowest Tax Rates

New Jersey Sales Use Tax Guide Avalara

How To File And Pay Sales Tax In Missouri Taxvalet

Statement Of No Tax Due Harrisonville Mo Official Website

Missouri Dor Tax Resolutions Consequences Of Back Taxes

![]()

Pay Individual Income Taxes Online

Missouri Tax Deadline Still April 15 But Penalties Waived If Paid Within 90 Days

Sales Taxes In The United States Wikipedia

Sales Tax Laws By State Ultimate Guide For Business Owners

Solar Tax Credit What If Your Tax Liability Is Too Small Palmetto

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities